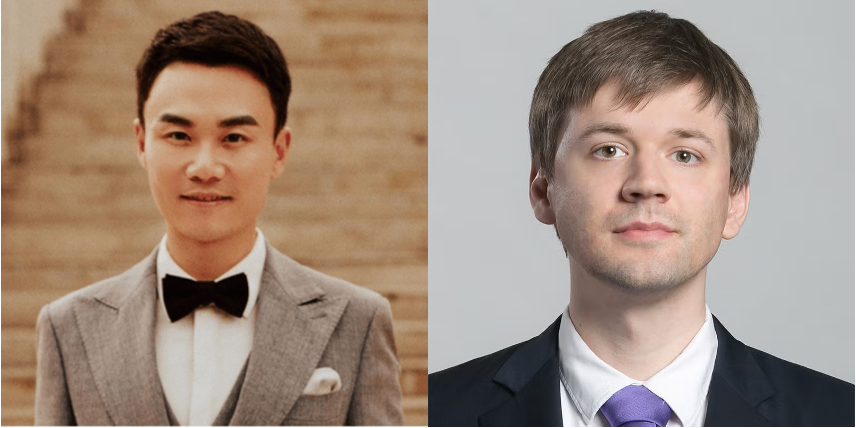

Ye Chen and Ilya O. Ryzhov Win the 2025 Outstanding Simulation Publication Award

Ye Chen (left) and Ilya O. Ryzhov (right)

The INFORMS Simulation Society’s Outstanding Publication Award recognizes exceptional contributions to the simulation literature in the form of articles, books, book chapters and monographs, copyrighted between 2022 and 2024. The award committee, consisting of Michael Fu (chair), Henry Lam, and Raghu Pasupathy are pleased to present the 2025 Award to Ye Chen and Ilya O. Ryzhov for their paper:

"Balancing Optimal Large Deviation in Sequential Selection", which appeared in Management Science, 69(6), 3457-3473, June 2023.

The ranking and selection problem is prominent in the simulation literature, not only because of its practical importance, but because it offers a well-defined mathematical framework in which to study certain fundamental questions. What is the best way to divide a simulation budget between different feasible solutions? When should we focus on a tried-and-true solution, and when should we experiment with one that we don't know well?

One approach that has yielded detailed answers to these questions is based on large deviations theory. The optimal budget allocation can be described using a system of equations that explicitly control the tradeoffs between value and uncertainty, between simulating the best system and simulating others in order to learn that they are not the best. The problem is that these equations depend on the same unknown performance values that we are trying to learn, so in effect we are back where we started.

The paper by Chen and Ryzhov develops, not only a ranking and selection algorithm, but a general template for creating such algorithms in any simulation optimization problem to which large deviations analysis applies. Their approach is shown to learn the solution to the optimality conditions over time, without any tunable parameters, and in a computationally efficient way that does not require solving systems of equations. Its biggest advantage, however, is its generalizability. While this paper focuses on traditional ranking and selection, the algorithmic concepts are presented in a general manner, and there has since been other work, both by these authors and others, using this principle to create algorithms for other contexts.

Congratulations to the authors for a solid and remarkable piece of work!

--------------------------------------------------------------------------------------------------

Anand Deo and Karthyek Murthy Win the 2024 Outstanding Simulation Publication Award

Anand Deo (left) and Karthyek Murthy (right)

The INFORMS Simulation Society’s Outstanding Publication Award recognizes exceptional contributions to the simulation literature in the form of articles, books, book chapters and monographs, copyrighted between 2021 and 2023. The award committee, consisting of Jose Blanchet, Michael Fu, and Henry Lam are pleased to present the 2024 Award to Anand Deo and Karthyek Murthy for their paper:

"Achieving Efficiency in Black-Box Simulation of Distribution Tails with Self-Structuring Importance Samplers", which appeared in Operations Research (2023), Articles in Advance.

This paper introduces a novel approach to importance sampling that significantly broadens the scope of problems in which we can obtain variance reduction with asymptotic optimality guarantees. The common approach to achieve the latter guarantees is via a change of measure informed by large deviations theory which, while powerful, typically needs case-specific analysis and model assumptions. This paper puts together several innovative ingredients to bypass these restrictions. More specifically, by leveraging structural similarities in how risk events unfold at different tail levels, the authors construct an approach based on sample space transformation to induce a change of distribution, and show its robust variance reduction capability by building an associated large deviations theory. The invented approach demon- strably tackles a much wider range of models that are not amenable to established importance sampling methods.

Congratulations to the authors for a solid and remarkable piece of work!

--------------------------------------------------------------------------------------------------

David J. Eckman, Matthew Plumlee, and Barry L. Nelson win 2023 Outstanding Simulation Publication Award

David J. Eckman (left), Matthew Plumlee (middle), Barry L. Nelson (right)

Jose Blanchet (left, committee), Barry L. Nelson (middle), and David J. Eckman (right)

Jose Blanchet (left, committee), Barry L. Nelson (middle), and David J. Eckman (right)

The INFORMS Simulation Society’s Outstanding Publication Award recognizes exceptional contributions to the simulation literature in the form of articles, books, book chapters and monographs, copyrighted between 2020 and 2022. The award committee, consisting of Jose Blanchet, Henry Lam and Enlu Zhou are pleased to present the 2023 Award to David J. Eckman, Matthew Plumlee, and Barry L. Nelson for their paper:

"Plausible Screening Using Functional Properties for Simulations with Large Solution Spaces", which appeared in Operations Research (2022), 70(6):3473-3489

This paper proposes screening methods for simulation optimization problems with extremely large solution spaces. Using structural properties of the performance function, the proposed methods measure discrepancies between observed data and consistent functions to eliminate solutions unlikely to meet optimality criteria. The power of the proposed screening framework is its ability to offer valuable statistical inference about solutions that have not even been simulated, without imposing a probabilistic prior on the performance function. This contribution opens up promising new lines of inquiry, motivating many interesting questions related to experimental design and computational methods, among other areas.

Congratulations to the authors for a solid and remarkable piece of work!

--------------------------------------------------------------------------------------------------

Soumyadip Ghosh and Henry Lam win 2022 Best Simulation Publication Award

Soumyadip Ghosh (left) and Henry Lam (right)

Soumyadip Ghosh (left) and Henry Lam (right)

The INFORMS Simulation Society’s Outstanding Publication Award recognizes exceptional contributions to the simulation literature in the form of articles, books, book chapters and monographs, copyrighted between 2019 and 2021. The award committee, consisting of Jose Blanchet, Jian-Qiang Hu, and Enlu Zhou, are pleased to present the 2022 Award to Soumyadip Ghosh and Henry Lam for their paper:

“Robust Analysis in Stochastic Simulation: Computation and Performance Guarantees”, which appeared in Operations Research, 67(1), 2019, 232-249.

This paper investigates a distributionally robust optimization framework to quantify input uncertainty, which refers to the errors in calibrating input models that propagate to impact the outputs in simulation analysis. While conventional approaches for input uncertainty place basic statistical assumptions on the calibration process and suggest established techniques such as the bootstrap, in practice the uncertainty in the input models could go beyond such assumptions and tie to hidden dependence, expert knowledge or non-stationarity of data. This approach aims to compute worst-case bounds under constraints designed to flexibly represent partial knowledge of the input models beyond conventional statistical errors. This paper studies guarantees on these bounds and designs numerical schemes for computation. This contribution is important for simulation analysis and design.

Congratulations to the authors for a solid and remarkable piece of work!

--------------------------------------------------------------------------------------------------

Jose Blanchet, Coralia Cartis, Matt Menickelly, and Katya Scheinberg win 2021 Best Simulation Publication Award

The INFORMS Simulation Society’s Outstanding Publication Award recognizes exceptional contributions to the simulation literature in the form of articles, books, book chapters and monographs, copyrighted between 2018 and 2020. The award committee, consisting of Jian-Qiang Hu (Chair), Pierre L'Ecuyer, and Enlu Zhou, are pleased to present the 2021 Award to Jose Blanchet, Coralia Cartis, Matt Menickelly, and Katya Scheinberg for their paper:

“Convergence Rate Analysis of a Stochastic Trust-Region Method via Supermartingales,” which appeared in INFORMS Journal on Optimization, 1(2) (2019), 92-119.

Iterative simulation-based stochastic optimization algorithms are a very important class of tools not only in the simulation community, but in many other areas including machine learning, where they are really a central tool for learning good neural network parameters. Their convergence has been analyzed at length in certain cases, such as for the classical stochastic approximation method under certain simplifying assumptions. But the methods that currently work well in large applications such as machine learning are more complicated and the simplifying assumptions typically do not hold. Stochastic trust-region methods with adaptive step sizes, can have several variants that are hard to analyze theoretically.

This paper provides a general framework for rigorous convergence analysis of such methods in terms of the expected number of iterations required to reach a neighborhood of the optimal solution, in a very general setting that covers many algorithms, under the assumption that the gradient (or Hessian, in the second-order case) can be estimated with sufficient accuracy. The analysis uses Lyapunov functions and martingale analysis to provide bounds on the expected number of iterations. The approach can potentially apply to many other simulation-optimization algorithms. This paper has attracted a lot of interest in both the machine learning and optimization communities. It is among a set of papers by some of these authors on the convergence of these types of stochastic optimization algorithms in slightly different frameworks. These papers together constitute a very important and impactful contribution overall.

Congratulations to the authors for a remarkable piece of work!

--------------------------------------------------------------------------------------------------

Di Wu, Helin Zhu and Enlu Zhou win 2020 Best Simulation Publication Award

The INFORMS Simulation Society’s Outstanding Publication Award recognizes exceptional contributions to the simulation literature in the form of articles, books, book chapters and monographs, copyrighted between 2017 and 2019. The award committee, consisting of Pierre L'Ecuyer, Christine Currie and Jian-Qiang Hu, are pleased to present the 2020 Award to Di Wu, Helin Zhu and Enlu Zhou for their paper:

“A Bayesian Risk Approach to Data-Driven Stochastic Optimisation: Formulations and Asymptotics,” which appeared in SIAM Journal on Optimization, 28(2) (2018), 1588-1612.

This paper proposes a Bayesian Risk Optimization (BRO) framework for stochastic optimization problems in which the stochastic model has unknown input distributions. Instead of fitting specific distributions to data and then solving the resulting optimization problem by assuming that these are the true distributions in the system, as often assumed in simulation studies, this approach uses a Bayesian formulation conditional on the data, together with a flexible risk measure that can be selected by the user.

The risk measures considered in the paper are the mean, a linear combination of mean and variance, the value-at-risk, and the conditional value-at-risk.

The authors formalize BRO and prove rigorously its asymptotic consistency and normality. This implies that the BRO problem converges to the true problem as the amount of data increases. The asymptotic normality permits one to quantify the uncertainty in the BRO objective value. For that, they prove a CLT for each risk measure considered.

The main contribution of the paper is to provide a theoretical study of the general methodology. This contribution is important and relevant for a very broad class of applications. We believe this paper will have a long-lasting impact.

Congratulations to the authors for a remarkable piece of work!

--------------------------------------------------------------------------------------------------

Yijie Peng, Michael C. Fu, Jian-Qiang Hu, and Bernd Heidergott win 2019 Outstanding Simulation Publication Award

Pierre L’Ecuyer, Michael Fu, Yijie Peng, and Jian-Qiang Hu

The winners of the INFORMS Simulation Society Outstanding Publication Award for 2019 are Yijie Peng, Michael Fu, Jian-Qiang Hu and Bernd Heidergott for their article titled "A New Unbiased Stochastic Derivative Estimator for Discontinuous Sample Performances with Structural Parameters".

This paper develops a general type of unbiased estimator for the derivative of a mathematical expectation with respect to a model parameter θ. Stochastic derivative estimation by simulation is a very important problem with a relatively long and rich history in the I-SIM community. It is very important in particular for sensitivity analysis and for stochastic optimization with respect to continuous decision parameters.

The best known methods for derivative estimation are infinitesimal perturbation analysis, the likelihood ratio method, and the weak derivative approach. Variants and hybrids of these methods have also been proposed over the last 30 years. However, a key challenge has been handling discontinuities in the sample performances for non-distributional parameters, which arise in a wide variety of applications, from financial engineering to production/inventory management.

In their paper, Peng, Fu, Hu, and Heidergott propose a new approach named the generalized likelihood ratio (GLR) method, capable of dealing with a large scope of discontinuities in a general framework. GLR expands the applicability of gradient estimation techniques in a systematic way, by generalizing the three methods mentioned above. It provides a single-run unbiased derivative estimator of an expectation with respect to θ in the case where the sample performance measure is discontinuous with respect to θ and its probability distribution as well as its support may also depend on θ. Many existing and new applications with discontinuities can potentially be treated by the new method in a unified manner. The paper opens up further topics for investigation. In follow-up work, the authors apply their method to calibrating parameters in misspecified stochastic models, estimating sensitivities of a distortion risk measure used in behavioral economics, estimating the derivative of a quantile, and training discontinuous artificial neural networks.

Congratulations for a deep, solid, and remarkable piece of work!

--------------------------------------------------------------------------------------

Boris N. Oreshkin, Nazim Réegnard, and Pierre L’Ecuyer win 2018 Outstanding Simulation Publication Award

Left to right: Raghu Pasupathy, Pierre L’Ecuyer, Björn Johansson

The selection committee enthusiastically agrees and is pleased to give the INFORMS Simulation Society’s Outstanding Publication Award to Boris N. Oreshkin, Nazim Réegnard, and Pierre L’Ecuyer for their paper:

Rate-Based Daily Arrival Process Models with Application to Call Centers, Operations Research 64 (2) 510–527, 2016

- The authors explore an important problem in the area of input modeling. In particular, the authors propose, develop and compare new stochastic models for the daily arrival rate in a call center.

- Current models often presume certain independence features across time periods, but the authors argue that this may not be sufficiently realistic for assessing the performance or for making system design decisions. The authors propose and analyze models which account for dependence across these time periods, and develop specialized techniques for doing so.

- Along the way, they explore the relationship between arrival rates, for which maximum likelihood techniques may be challenging due to the lack of direct observability of the rates, and the counts for arrivals in the periods. Counts have the advantage of being observable.

- Although the main focus of the article is on the arrival processes for call centers, which comprise a significant sector of the economy, its contributions are also relevant for models of other important applications, such as arrival processes for retail, health services, restaurant services, and service management more generally.

- The authors have done a fine job of linking together theory for input process modeling, probabilistic tools such as normal copulas to explore correlations, and integration with both call center data and data from a major utility company to demonstrate the characteristics of their proposal.

Ilya Ryzhov wins 2017 Outstanding Simulation Publication Award

Left to right: Ilya Ryzhov, Barry Nelson

Left to right: Ilya Ryzhov, Barry Nelson

The selection committee enthusiastically agrees and is pleased to give the INFORMS Simulation Society’s Outstanding Publication Award to Ilya Ryzhov for his paper:

Ryzhov, I. 2016. On the convergence rates of expected improvement methods, Operations Research, 64(6), 1515-1528.

Only in simulation is “complete enumeration” an optimization method; this is the case because we can only estimate system performance, simulation of feasible solutions does actually cost time or money, and the cost can be considerable when the number of feasible solutions is large or the simulation is slow. We tend to want to make simulation optimization problems into complete enumeration problems---better known as ranking & selection problems---because it is the one type of optimization that we know how to do effectively. When I say we know how to do it “effectively” I mean that there are a bunch of us with different approaches who argue that we know how to do it “more effectively” than the other folks do.

Dr. Ryzhov’s paper does not introduce a new ranking and selection method. Instead, it shines an incisive light on the performance of a class of methods that have great intuitive appeal and mountains of good empirical performance, but have defied a rigorous comparison with other approaches: these are the so-called “expected improvement” or EI methods. Typically defined within a Bayesian setting, EI uses the current joint posterior distribution of the objective function values of all feasible solutions to assess the upside of exploring each of them next, relative to what we know now. EI methods are therefore naturally sequential, which is good, but myopic, which might seem to be bad. However, Dr. Ryzhov shows that, under fairly broad conditions, following the EI prescription leads to simulating the systems such that their sampling ratios are asymptotically the same as those of Optimal Computing Budget Allocation, which is known to yield near optimal performance in ranking and selection. Not only is the analysis clever, but it clarifies the relationships among several EI variants. Quoting the nomination letter, “I believe that this paper represents a fundamental unifying development in R&S.”

Chang-Han Rhee and Peter Glynn win 2016 Best Simulation Publication Award

The INFORMS Simulation Society’s Outstanding Publication Award recognizes exceptional contributions to the simulation literature in the form of articles, books, book chapters and monographs, copyrighted between 2013 and 2015. The award committee, consisting of Jeff Hong, Jeremy Staum and Barry Nelson, are pleased to present the 2016 Award to Chang-Han Rhee and Peter Glynn for their paper:

“Unbiased Estimation with Square Root Convergence for SDE Models,” which appeared in Operations Research, Volume 63 (2015), 1026--1043.

The paper formalizes an idea by which a given sequence of biased estimators that converge to a quantity of interest can be strategically manipulated to construct an unbiased estimator of the quantity. It then applies this novel idea to the specific context of solving stochastic differential equations (SDEs), resulting in a method that is guaranteed to achieve the canonical square root convergence rate for any SDE solution scheme having strong order p > 1/2. But, as pointed out by the nominator, the contribution of this paper is “more far-reaching [than the SDE example] in that it opens the door for researchers to pursue similar but specific schemes for use within other areas,” such as derivative estimation, simulation optimization and function approximation. The committee adds that for a paper so technically deep, the exposition is amazingly clear.

Russell Barton, Barry Nelson, and Wei Xie win 2015 Best Simulation Publication Award

Left to right: Russell Barton, Jeremy Staum, Barry Nelson, and Wei Xie

Left to right: Russell Barton, Jeremy Staum, Barry Nelson, and Wei Xie

The award committee, consisting of David Goldsman, L. Jeff Hong, and Jeremy Staum, presented the 2015 Outstanding Simulation Award to Russell Barton, Barry Nelson, and Wei Xie for their papers:

- Russell R. Barton, Barry L. Nelson, and Wei Xie (2014). “Quantifying Input Uncertainty via Simulation Confidence Intervals,” INFORMS Journal on Computing 26(1): 74–87.

- Wei Xie, Barry L. Nelson, and Russell R. Barton (2014). “A Bayesian Framework for Quantifying Uncertainty in Stochastic Simulation,” Operations Research 62(6): 1439–1452.

Accounting for uncertainty in the inputs to a simulation model is an important problem in simulation experiment design and analysis. These papers provide practical and theoretically compelling solutions to the problem, while being extremely well-written and accessible. The papers provide methods to generate a bootstrap confidence interval or a Bayesian credible interval for the true performance of the simulated system given the unknown true values of the inputs. To reduce the computation cost of doing this, the proposed methods harness the power of stochastic kriging metamodeling. This avoids relying on a simpler metamodel, such as a linear metamodel, to be accurate. There is also an advance in justifying the use of bootstrapping because the metamodel is smoother than simulation output.

Vijay Desai, Vivek Farias, and Ciamac Moallemi win 2014 Best Simulation Publication Award

The award committee, consisting of David Goldsman, Marvin Nakayama, and Jeremy Staum, presented the 2014 Outstanding Simulation Publication Award to Vijay Desai, Vivek Farias, and Ciamac Moallemi for their paper:

V. Desai, V. Farias, and C. Moallemi, “Pathwise Optimization for Optimal Stopping Problems,” Management Science, Vol. 58, No. 12, Dec. 2012, pp. 2292‒2308.

Over the last two decades, simulation optimization has emerged as an important and thriving area of research. Besides being interesting from a theoretical point of view, simulation optimization has a wide variety of practical applications, including real option management of commodities, the pricing of financial derivatives, inventory optimization, and supply chain management. But optimization problems, especially in high-dimensional settings, are difficult and time-consuming to solve via naive simulation. Improving the performance of simulation optimization algorithms has been a longstanding goal.

The authors propose a new convex optimization procedure that uses a dual characterization of optimal stopping problems to establish upper and lower bounds on the optimal solution to the underlying optimization problem. In fact, the paper is distinctive in formulating an optimal stopping problem as a convex optimization problem; and it turns out that this insight makes the procedure very fast, despite being simulation-based.

From a theoretical perspective, the paper includes very nice results on martingale duality and bounds based on a Markov chain notion of predictability. At the same time, both the problem and the proposed solution are quite practical. In addition, the paper is extremely well written and accessible, despite its mathematical sophistication.

There has been a great deal of work in recent years on simulation-based methods for optimal stopping problems, but this paper stands out for its combination of theoretical and practical contributions. In fact, this paper makes valuable contributions to several strands of research: simulation-based optimization, approximate dynamic programming, and simulation methods for finance.

Bruce Ankeman, Barry Nelsom, and Jerry Staum Receives 2013 Best Simulation Publication Award

The award committee, consisting of Marvin Nakayama, David Goldsman, and Pierre L’Ecuyer, are pleased to present the 2013 Outstanding Simulation Publication Award to Bruce Ankenman, Barry L. Nelson, and Jeremy Staum:

B. Ankenman, B. L. Nelson, and J. Staum. Stochastic Kriging for Simulation Metamodeling.Operations Research, Vol. 58, No. 2, March-April 2010, pp. 371-382.

This article extends kriging for deterministic computer experiments to stochastic kriging for metamodeling; demonstrates importance of incorporating both intrinsic uncertainty in stochastic simulation and extrinsic uncertainty of the unknown response surface; and shows that some conventional wisdom in metamodeling doesnot hold.

L. Jeff Hong and Guangwu Liu win 2012 Best Simulation Publication Award

Hong, L. Je . 2009. Estimating quantile sensitivities. Operations Research

and

Hong, L. Je and Guangwu Liu. 2009. Simulating sensitivities of conditional value-at-risk. Management Science

Quantiles of random performance distributions are often used as measures of risk in fi nance or to measure the quality of service in certain systems. Good quantile estimators have been available for a long time. But there are many situations, for example in optimization contexts, where the performance random variable depends on a parameter θ and we want to estimate the derivative of the quantile with respect to θ. This is much more difficult.

In the first article, Jeff Hong shows how to write this derivative as a conditional expectation, and constructs an asymptotically unbiased stochastic derivative estimator based on that. This estimator turns out not to be consistent, but Hong leverages it to construct a consistent estimator by batching data and averaging independent copies. He studies the large-sample behavior and derives a central limit theorem for the resulting estimator. The method is easy to implement and is applicable to a large class of problems. The construction is based on a new approach to estimate the derivative of the expectation of a discontinuous function, via perturbation analysis. This approach has already found applications in subsequent papers.

The second article considers estimating the derivative for another popular risk measure, the conditional value at risk (CVaR), which is the expected value conditional on being larger than a certain quantile. Hong and Liu show how to write this derivative as a conditional expectation, propose an estimator, analyze its asymptotic properties, demonstrate its use in optimization settings where the CVaR appears in the objective or in constraints, and perform numerical studies.

As one of the nominators puts it: These papers are the kind of work that, in retrospect, we might wish we had written because of the creativity and clarity of thinking involved.

Michael Giles Receives 2011 Outstanding Simulation Publication Award from the INFORMS Simulation Society

When we simulate the sample path of a stochastic process defined by a stochastic differential equation, except in simple special cases, we must discretize the time, and replace any estimator defined as a function of the sample path by a function of the process values at the discretization points. A too crude discretization gives too much bias for the estimator, whereas a too fine discretization makes the simulation too expensive to run.

In his paper ``Multilevel Monte Carlo Path Simulation,'' published in Operations Research in 2008, Michael Giles developed a method based on clever multigrid ideas in numerical analysis, that provides an estimator with the same low bias and almost the same variance as an estimator based on a very fine grid, with a computing effort comparable to that required with a crude discretization.

The idea is to select a decreasing sequence of discretization time steps, and write the estimator for the finest discretization as equal to the estimator for the coarsest one plus a sum of corrections, where each correction is the difference between the estimators at two successive time steps. We first run the simulation at the coarse discretization for a large sample size, then we estimate each correction term independently by simulating the difference with carefully synchronized common random numbers, using a sample size that decreases when the time step decreases. Much smaller sample sizes can be used for the corrections at the finer levels because these corrections have much smaller variances. The efficiency improvement is characterized in the paper by a general theorem showing that the computing effort often increases, as a function of one over the mean square error, at a slower rate than with the standard Monte Carlo method.The achieved rate depends on how the variance of the correction and the bias behave as a function of the time step, for the application at hand. A similar technique was proposed earlier by Stefan Heinrich for the different problem of estimating a function of a continuous parameter everywhere in a finite interval, by Monte Carlo, when only noisy observations of the function are available.

The proposed method applies to various discretization schemes, including Euler and Milstein methods. In the prize-winning paper, its efficiency was illustrated with option pricing problems in finance. Subsequent papers have examined the combination with quasi-Monte Carlo, estimation of sensitivities, jump-diffusion processes, stochastic partial differential equations, and applications to other areas than finance.

This work is a significant breakthrough in Monte Carlo methods for stochastic differential equations, and is already having a large impact on simulation research in finance.

Paul Dupuis, Kevin Leder, and Hui Wang Receive 2010 Outstanding Simulation Publication Award from the INFORMS Simulation Society

The 2010 Outstanding Simulation Award was awarded to Paul Dupuis and Hui Wang (Brown University) and Kevin Leder (Harvard University) for their two papers: “Subsolutions of an Isaacs Equation and Efficient Schemes for Importance Sampling” which appeared in Mathematics of Operations Research in 2007, and “Importance Sampling for Sums of Random Variables with Regularly Varying Tails” which appeared in ACM Transactions on Computer Modeling and Simulation in 2007. The awards committee consisted of Peter Glynn (chair), Christos Alexopoulos and Athanasios Avramidis.

Awardees of 2009 and prior

2009-- Avramidis, Athanassios (Thanos) and Pierre L'Ecuyer. 2006. Efficient Monte Carlo and quasi-Monte Carlo option pricing under the variance-gamma model, Management Science 52(12): 1930-1944.

2008 -- Asmussen, Soren and Peter Glynn. 2007. Stochastic Simulation: Algorithms and Analysis, New York: Springer.

2007 --

1. Alexopoulos, Christos and David Goldsman. 2004. To Batch Or Not To Batch?, ACM TOMACS, 14 (1): 76-114.

2. Duchon, Philippe, Philippe Flajolet, Guy Louchard, and Gilles Schaeffer. 2004. Boltzmann Samplers for Random Generation of Combinatorial Structures, Combinatorics, Probability and Computing.

2006 -- Boesel, Justin, Barry Nelson and Seong-hee Kim. 2003. Using Ranking and Selection to "Clean Up" After Simulation Optimization. Operations Research 51(5): 814-825.

2005 -- Glasserman, Paul. 2003. Monte Carlo Methods in Financial Engineering, New York: Springer.

2004 -- Not given.

2003 -- Haas, Peter. 2002. Stochastic Petri Nets: Modelling, Stability, Simulation, New York: Springer.

2002 -- Asmussen, Soren, Klemens Binswanger, and Bjarne Hojgaard. 2000. Rare events simulation for heavy-tailed distributions. Bernoulli, 6 (2): 303-322.

2001 -- Law, Averill M., and W. David Kelton. 1999. Simulation Modeling and Analysis, 3rd edition, New York: McGraw-Hill.

2000 -- Propp, James and David Wilson. 1996. Exact Sampling with Coupled Markov Chains and Applications to Statistical Mechanics. Random Structures and Algorithms, volume 9 , 223-252. 1998. Coupling from the past: a user's guide. Microsurveys in Discrete Probability, Volume 41 of DIMACS Series in Discrete Mathematics and Theoretical Computer Science, 181--192. American Mathematical Society.

1999 -- L'Ecuyer, Pierre. 1996. Combined Multiple Recursive Random Number Generators. Operations Research, 44 (5), 816--822. Maximally Equidistributed Combined Tausworthe Generators. Mathematics of Computation, 65 (213), 203-213.

1998 -- Fu, Michael, and Jian-Qiang Hu. 1997. Conditional Monte Carlo: Gradient Estimation and Optimization Applications. Boston: Kluwer Academic Press.

1997 -- Fishman, George. 1996. Monte Carlo: Concepts, Algorithms, and Applications. New York: Springer-Verlag.

1996 -- Shahabuddin, Perwez. 1994. Importance sampling for the simulation of highly reliable Markovian systems. Management Science 40 (3): 333-352.

1995 -- Niederreiter, Harald. 1992. Random number generation and quasi--Monte Carlo methods. Philadelphia: Society for Industrial and Applied Mathematics.

1994 -- Fujimoto, Richard M. 1990. Parallel discrete event simulation. Communications of the ACM 33 (10): 30-53.

1993 -- Fox, Bennett L., and Peter W. Glynn. 1990. Discrete-time conversion for simulating finite-horizon Markov processes. SIAM Journal on Applied Mathematics 50 (5): 1457-1473.

1992 -- Glasserman, Paul. 1991. Gradient estimation via perturbation analysis. Boston: Kluwer Academic Publishers.

1991 -- Whitt, Ward. 1989. Planning queueing simulations. Management Science 35 (11): 1341-1366.

1990 -- Heidelberger, Philip , Xi-Ren Cao, Michael A. Zazanis, and Rajan Suri. 1988. Convergence properties of infinitesimal perturbation analysis estimates. Management Science 34 (11): 1281-1302.

1989 -- Devroye, Luc. 1986. Non-uniform random variate generation. New York: Springer-Verlag.

1988 -- Zeigler, Bernard P. 1984. Multifacetted modelling and discrete event simulation. London: Academic Press.

1987 -- Schruben, Lee W. 1983. Confidence interval estimation using standardized time series. Operations Research 31 (6): 1090-1108.

1986 -- Not given.

1985 -- Wilson, James R., and A. Alan B. Pritsker. 1984. Experimental evaluation of variance reduction techniques for queueing simulation using generalized concomitant variables. Management Science 30 (12): 1459-1472.

1984 -- Not given.

1983 (tie) -- Meketon, Marc S., and Philip Heidelberger. 1982. A renewal theoretic approach to bias reduction in regenerative simulations. Management Science 28 (2): 173-181.

1983 (tie) -- Law, Averill M., and W. David Kelton. 1982. Confidence interval procedures for steady-state simulations, II: A survey of sequential procedures. Management Science 28 (5): 550-562.

1982 -- Lavenberg, Stephen S., and Peter D. Welch. 1981. A perspective on the use of control variables to increase the efficiency of Monte Carlo simulations. Management Science 27 (3): 322-335.

1981 -- Schruben, Lee W. 1980. A coverage function for interval estimators of simulation response. Management Science 26 (1): 18-27.